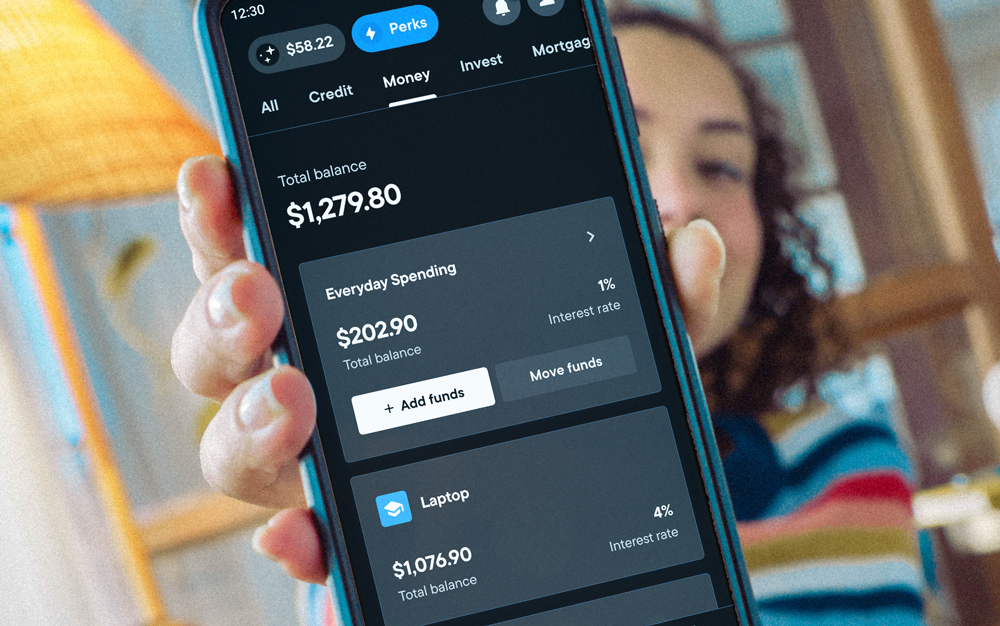

Imagine banking that feels as natural and intuitive as sending a text. In today’s fast-evolving world of finance, customer experience (CX) is redefining how we bank. Neo Financial, a Canadian challenger bank, is shaking up a centuries-old industry. If you’re interested in learning how one of Canada’s most innovative financial institutions prioritizes customer-centricity and uses cutting-edge tech to solve customer pain points, Shannon Burch, Vice President of Experience at Neo Financial, offers a compelling look into the future of CX.

When Shannon joined Neo Financial, she brought over two decades of experience from some of the world’s leading banks. For her, customer experience goes beyond just customer service—it’s the entire journey, from app design to human touchpoints. Shannon emphasizes that Neo’s success lies in treating every department—product, engineering, marketing—as part of the customer journey. At Neo, everyone is a contributor to the customer experience, which Shannon believes creates a unique sense of collaboration and community.

Neo’s approach is all about breaking the mold. Instead of lengthy training sessions, Neo relies on a real-time knowledge-sharing system that empowers staff with the right answers at their fingertips. This system reduces training time and enables employees to focus more on solving customer issues creatively and efficiently. This innovative approach saves time and resources and supports an environment where employees can thrive.

Neo’s approach is all about breaking the mold. Instead of lengthy training sessions, Neo relies on a real-time knowledge-sharing system that empowers staff with the right answers at their fingertips. This system reduces training time and enables employees to focus more on solving customer issues creatively and efficiently. This innovative approach saves time and resources and supports an environment where employees can thrive.

Technology plays a huge role in Neo’s mission. From chatbots that resolve inquiries with impressive speed to a “test-and-learn” approach with artificial intelligence (AI), Neo integrates tech to streamline the banking experience. For instance, automated chat has drastically reduced customer wait times, and predictive tools have improved customer satisfaction by allowing Neo to anticipate needs before they arise. Shannon’s goal is to use technology to handle routine inquiries, allowing her team to focus on helping customers with complex or sensitive issues.

Customer stories fuel Shannon’s passion, especially when they involve resolving real-life issues through collaboration and empathy. One story that stands out is about a single mother who, thanks to Neo’s innovative approach, found financial support when she needed it most. These stories highlight how Neo doesn’t just provide banking solutions but empowers customers in ways they haven’t experienced before.

Shannon’s vision for the future of CX at Neo is clear: a seamless, efficient experience that feels personal. She’s excited to bring this vision to life, helping customers navigate their finances in a refreshingly straightforward way.

For a deeper dive into Shannon’s insights and the incredible work Neo Financial is doing to disrupt the status quo in banking, check out our full KIA Spotlight article in the October 2024 issue of CX Insight magazine.

TELUS Digital

TELUS Digital ibex delivers innovative BPO, smart digital marketing, online acquisition technology, and end-to-end customer engagement solutions to help companies acquire, engage and retain customers. ibex leverages its diverse global team and industry-leading technology, including its AI-powered ibex Wave iX solutions suite, to drive superior CX for top brands across retail, e-commerce, healthcare, fintech, utilities and logistics.

ibex delivers innovative BPO, smart digital marketing, online acquisition technology, and end-to-end customer engagement solutions to help companies acquire, engage and retain customers. ibex leverages its diverse global team and industry-leading technology, including its AI-powered ibex Wave iX solutions suite, to drive superior CX for top brands across retail, e-commerce, healthcare, fintech, utilities and logistics.

Trista Miller

Trista Miller