What if one of the most significant limitations in customer experience (CX) isn’t technology but how organizations think about customer relationship management (CRM)?

Brett Charobee has spent over two decades leading CRM, loyalty, personalization, and MarTech initiatives for consumer-driven brands, including Subway, CVS, Fanatics, and StockX. He has focused on turning fragmented customer data into experiences that feel personal, relevant, and trustworthy at scale.

Most recently, as Vice President of Global Personalization & Guest Affinity at Subway, he led enterprise CRM and loyalty transformation across more than 20 markets, unifying data, channels, and technology into a single operating system for customer engagement, driving measurable gains in acquisition, retention, and lifetime value.

In this Q&A Spotlight, Brett unpacks the moments that shaped his conviction that CRM is not a tech stack, it’s an experience strategy. From uncovering hidden customer intent in purchase behavior to closing the long-standing gap between marketing and customer service data, he explains how empathy scales only when information flows freely across the organization. His experience reveals what happens when CRM becomes connective tissue rather than a channel, where emotional context informs decisions, loyalty becomes predictable, and customer experience is designed with intention instead of assumption.

Execs In The Know (EITK): Every CX leader has a moment where customer behavior, data, or an interaction exposes something bigger. What was that early moment for you that shifted how you viewed the customer relationship?

Brett Charobee: Early in my career, I was trained in databases, structured query language (SQL), and systems design, but I didn’t yet understand how technology translated to human experience. That changed when I joined ProFlowers. I was a customer myself, so I finally understood how data could improve something deeply personal like buying flowers for an anniversary, a birthday, or a holiday.

That’s when it clicked: customer data wasn’t just operational, it was emotional. Occasions, urgency, and intent mattered as much as transaction history. From that point forward, I stopped thinking in terms of campaigns and started thinking in terms of people.

CRM wasn’t about managing customers. It was about understanding them and using that understanding to drive better business decisions.

EITK: Looking back, what was the first role or project that made you realize, “This is CX, and this is where I want to build my career”?

Brett: At ProFlowers, we were running broad email campaigns featuring red roses, but as I queried our campaign conversion data, I noticed that a meaningful share of customers were clicking and buying plants instead. We dug into the data and realized something bigger: we weren’t a one-size-fits-all company. We were serving multiple, invisible customer missions.

That insight led to the launch of ProPlants.com.

That was my “aha” moment: data wasn’t just describing behavior, it was revealing untapped businesses and customer needs inside the company, with real revenue and growth implications. I realized CX wasn’t a support function; it was a growth engine.

Promoting a product and driving a purchase are not the same thing. When teams focus only on incremental orders as a KPI, they often miss the more important signal — what customers actually buy when they convert. Product-level analysis reveals hidden patterns in intent and behavior, unlocking more precise segmentation and more relevant contact strategies.

EITK: You’ve led CRM, loyalty, and personalization at brands like Subway, StockX, Fanatics, CVS, and more. When you look back, what were the key moments that shaped how you think about customer experience today?

Brett: Across industries, the same pattern emerged: Data tells the truth unless you ask the wrong question. At Fanatics, we believed women primarily purchased youth apparel for their children. A senior female leader interrupted and simply said:

“I buy youth apparel because it fits me better than women’s sizing.”

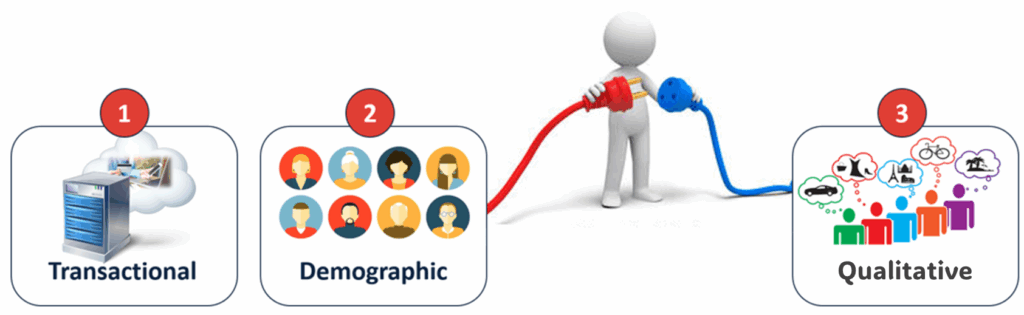

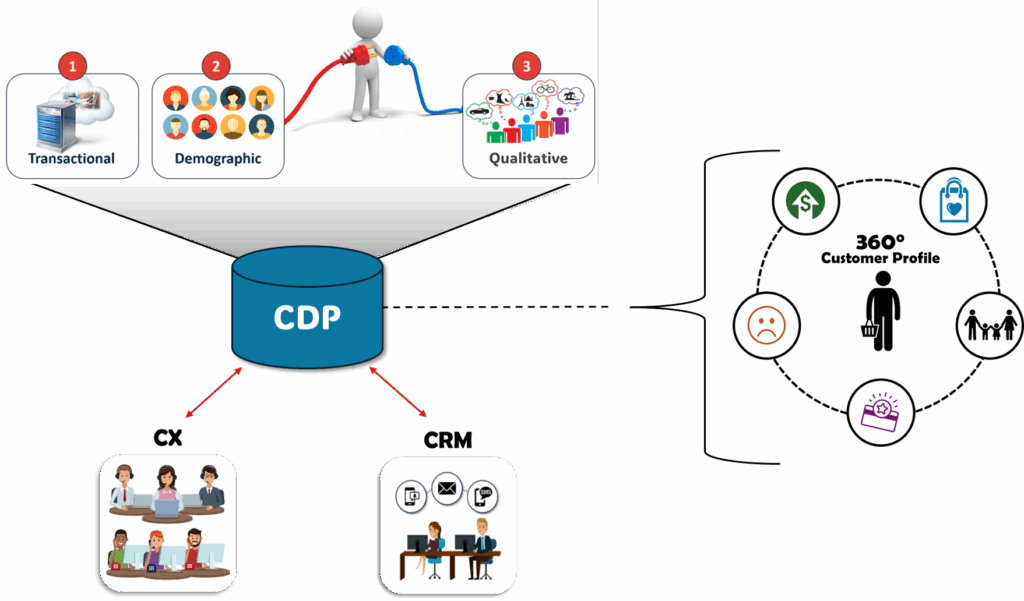

Two others immediately agreed. That moment reframed everything: Data without human context creates false confidence, and false confidence leads to poor strategic decisions at scale. Context without data creates gut-driven risk. True CX lives at the intersection. This is why I’m a firm believer in anchoring customer intelligence with three foundational data pillars (Transactional, Demographic, and Qualitative) before layering in more advanced signals.

EITK: Many leaders still treat CRM and CX as separate motions. When did it first “click” for you that CRM could actually be the engine of modern CX rather than just a marketing channel?

Brett: When customer service teams started driving outcomes without marketing knowing it. At one company, we discovered customers were redeeming promotions that CRM and Marketing hadn’t sent. The root cause? Customer service agents were issuing appeasement offers, but the data never flowed back to marketing.

Meanwhile, CRM and marketing teams unknowingly kept sending promotions and messaging to customers who were frustrated. Both teams were working in silos and were talking to the same customers. This resulted in customer confusion and frustration, and ultimately led to a decline in our retention rates.

So, we built a two-way data bridge:

- CRM data to customer service.

- Customer service data back to CRM.

That’s when CRM stopped being a channel and became the connective tissue that aligns experience, revenue, and enterprise decision-making.

EITK: At Fanatics, you had hundreds of customer attributes, but they weren’t connected to the service experience. What did it take, organizationally and technically, to finally close that data loop between CRM and customer service?

Brett: We had an executive whose order was delayed, and they’d contacted customer service about it. The package was delayed by three days due to a major storm in the region. The customer service team knew of the issue, but marketing didn’t. The CRM team continued to message the executive:

“How was your order?”

“Buy again.”

This was a horrible experience for a customer who hadn’t received their product. This experience became the enterprise-level catalyst — highlighting how disconnected systems silently erode trust, loyalty, and lifetime value.

Technically, it required:

- Shared identifiers

- Data normalization

- Real-time syncing

Organizationally, it required:

- Executive alignment and prioritization

Once leaders felt the pain personally, alignment followed quickly, centralizing customer attributes and integrating them across all customer-facing channels.

EITK: Once you connected marketing data with customer service data, what did you see in the numbers that surprised you most about new versus loyal customers?

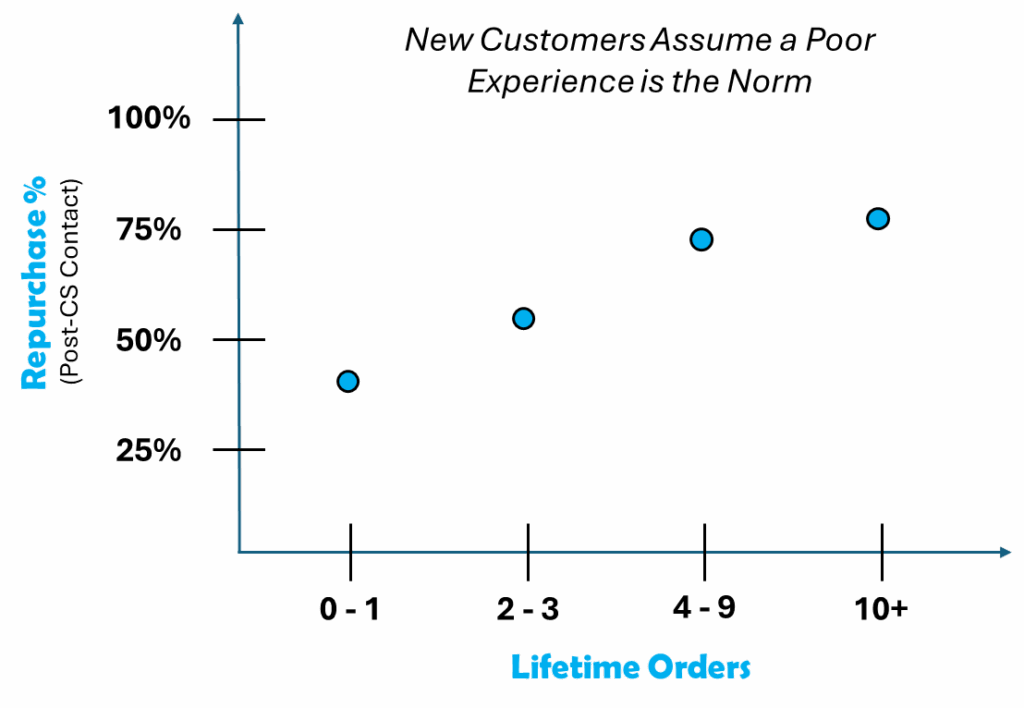

Brett: New customers were the most fragile and, therefore, the most economically important to protect. They churned at dramatically higher rates after customer service interactions, not because they were harder to please, but because they had no emotional reserve bank. Loyal customers assume a bad experience is an exception. New customers assume it’s the norm.

So, we redesigned our customer service strategy:

- Dedicated agents for new customers

- Personalized scripts for certain customer segments

- CRM-based appeasement journeys

We stopped treating all customers equally and started treating them correctly, which materially improved early-life retention and long-term loyalty.

EITK: You built tailored routing and playbooks for new customers calling into customer service, then mirrored that with nurturing and win-back journeys in CRM. How did that approach change retention and brand trust in practice?

Brett: The retention rates for new customers who contacted customer service increased by 25% in the first year of implementation, and our net promoter scores (NPS) started to increase. This initial improvement really shone a light on the fact that we were sitting on all this rich customer data, and that if we could centralize, normalize, and integrate it across our channels, we could dramatically improve the user experience.

EITK: You’ve said that “customer service data is emotional data.” How do you explain that idea to executives who still see service interactions primarily as cost or operations, not as a core part of the data strategy?

Brett: Because it records moments where trust is tested — moments that often determine whether a customer stays, leaves, or expands their relationship. Unfortunately, most companies treat service data as operational telemetry:

- Tickets

- Resolutions

- Average hold time (AHT)

But in reality, service data answers far more powerful questions:

- When are customers anxious?

- Where is trust breaking?

- What moments create churn risk?

- What triggers loyalty?

Customer service data is customer truth at the most human level. And CRM without emotional context is incomplete intelligence.

EITK: When you stepped into your role at Subway, leading personalization and guest affinity, what was the state of the organization, and what mandate were you given around loyalty, CRM, and the MarTech stack? As you look ahead, which emerging MarTech platforms or analytics approaches feel most promising, and which give you pause?

Brett: Like many brands, CRM was treated as a broadcast channel. The mandate was bold: “We don’t have millions of SKUs like Amazon. Prove personalization could drive measurable guest engagement, frequency, and revenue in a QSR environment.” We didn’t start with technology, which is where I see many companies fail. They think plugging in a new email service provider (ESP) or customer data platform (CDP) will solve the problem.

We started with the customer.

I built a customer data mart with hundreds of attributes, then integrated CRM systems (ESP, CDP, etc.), and rapidly moved the team from:

- Batch-and-blast → behavioral segmentation

The return on investment (ROI) followed quickly.

Technology doesn’t create personalization: Leadership and data discipline do.

EITK: When you look across your career, what through-line connects the wins you’ve had in loyalty growth, retention, and revenue impact, even across very different brands and industries?

Data is the only neutral referee inside an organization.

- When opinions clash, we test.

- When strategies stall, we test.

- When egos surface, we test.

This is why I prioritize building a test-and-learn methodology and process. CRM maturity isn’t about software; it’s about intellectual honesty and the ability to rapidly optimize your strategy for growth and incrementality.

EITK: What’s the mindset shift you want readers to make before reading Parts 2 and 3 of this blog series?

Brett: Stop treating CRM as infrastructure. Start treating it as a strategy and the nervous system of your customer experience. CRM is not a delivery system. It’s a decision system — one that informs revenue growth, retention strategy, and enterprise prioritization.

If you want personalization and artificial intelligence (AI) to work, the foundation must come first:

- Centralize your customer data into a single source of truth.

- Choose one meaningful customer problem to solve.

- Design a disciplined test-and-learn plan.

- Execute with focus and velocity.

CX doesn’t scale from tools. It scales from clarity, alignment, and leadership intent.

Closing the data loop between CRM and customer service is not a technology project; it’s a leadership decision.

When customer service data becomes part of your intelligence system (not just your operations dashboard), personalization becomes responsive, retention becomes predictable, and experience becomes intentional.

CX transformation doesn’t start with tools. It begins with truth.

In Part 2 of this series, we’ll move from foundation to execution and unpack how winning CRM teams scale personalization across channels and turn insight into action. Stay tuned.

About Brett Charobee

Brett Charobee is a senior marketing executive and customer growth leader specializing in CRM, loyalty, personalization, MarTech, and omni-channel strategy for consumer-driven brands. Over the past two decades, he has built and scaled customer-centric growth engines for global organizations, including Subway, CVS, Fanatics, and StockX. Most recently as VP of Global Personalization & Guest Affinity at Subway, Brett led enterprise CRM, loyalty, and MarTech transformation across 20+ markets and hundreds of millions of customers, unifying data, channels, and technology into a single operating system for customer engagement that drove meaningful gains in revenue, acquisition, retention, and lifetime value.

As a Chief Customer Officer–caliber leader, Brett is known for integrating customer experience, data, and commercialization into a single strategy. He transforms fragmented marketing, product, and data teams into integrated growth organizations—evolving CRM from a channel function into a predictive, AI-enabled revenue engine. His work centers on building omni-channel experiences that feel personal at scale while delivering measurable business impact. A frequent speaker and advisor on personalization, loyalty, and customer experience, Brett helps brands move from reactive marketing to customer-led growth.

TELUS Digital

TELUS Digital ibex delivers innovative BPO, smart digital marketing, online acquisition technology, and end-to-end customer engagement solutions to help companies acquire, engage and retain customers. ibex leverages its diverse global team and industry-leading technology, including its AI-powered ibex Wave iX solutions suite, to drive superior CX for top brands across retail, e-commerce, healthcare, fintech, utilities and logistics.

ibex delivers innovative BPO, smart digital marketing, online acquisition technology, and end-to-end customer engagement solutions to help companies acquire, engage and retain customers. ibex leverages its diverse global team and industry-leading technology, including its AI-powered ibex Wave iX solutions suite, to drive superior CX for top brands across retail, e-commerce, healthcare, fintech, utilities and logistics.

Trista Miller

Trista Miller